How severe are the consequences of price monopoly? Why shouldn’t companies earn huge profits?

Chairman Xianghong Yang

Suzhou Austen new Mstar Technology Ltd

In fact, every business is looking forward to earning as much profit as possible from the market. The gains we are talking about may come from your product, your service, or your monopoly position in the industry.

Since June 2016, China chemical companies has indeed changed a lot. They abandoned the idea of low-price strategy. They suddenly found that through years of hardworking, they had "accidentally" become monopolies in the industry. Or they may discover that sectors have become so concentrated that the drastic rise in price is happening in the market in China.

While in March and May prices fell sharply in most chemical markets, the resurgent producers make the price pullback fiercely from August.

We understand that companies make considerable profits by monopolizing the product in the industry. However, the market is an interdependent ecosystem. Making good gains should lie on the premise that the clients can continue to survive.

When it comes to industry monopolies, no companies can compare with the followings:

1, Microsoft Inc.,

Everyone knows that the Windows system had monopolized almost 90% of computers. Microsoft can make all counterfeits disappear overnight. In the meantime raise the price of its Windows operating system by ten times or more. And the market just can do nothing about it! But it won’t do that. While the Microsoft is profitable, it still wants its products to be affordable to its customers.

2, Google

We all know that there are two types of mobile operating system in the world. The first one is the IOS system of Apple. Apple integrated the system with the mobile phone as its market strategy. And the other one is the Android system of Google. Google has adopted a free business model for billions of people. If Google suddenly announces to charge Android users, even if the system costs $100, will Google be able to do that? Absolutely can! Can people do anything about it? The mobile phones manufacture other than Apple can do nothing about it, at least for now. But Google will never do that.

In another story, a famous camera manufacturer in Germany has a camera system that is known as the side axle system, which the company has been proud of all the time. However, it uses the high-price strategy, giving up sharing the profits with other manufacturers. It forced the Japanese to develop the famous Single Lens Reflex (SLR) system. Nowadays, more than 99% cameras in the world are SLR or MSR. That German company, however, still live in the old time with its the out-of-date side axle system. Countless enterprises thrive through sharing their profits with the whole industry.

Let's back to China's chemical industry. Some people say that the most profitable industrial chain this year is the pure benzene industrial chain. Companies making styrene, cyclohexanone-caprolactam, and aniline-MDI are all making a lot of money. Many of them are public traded companies. Therefore, we can judge from their financial statements that they are very profitable this year.

I remember that from May last year until January this year, butadiene's crazy price up-trend caused many businesses to abandon traditional synthetic rubber and switch to the new elastomer that does not content butadiene. That occurrence resulted in the market price of butadiene skyrocketed rising from 5, 000 yuan/ton on January last year to 26700 yuan/ton on January this year and then sharply fell to about 7, 500 yuan/ton this year. Although it rises to around 13000 yuan per ton in September this year, it fell again in October. One important thing about it is that a conglomerate heavily controls this product.

Let's talk about another famous elastomer-polyurethane elastomer, commonly known as TPU.

TPU is an excellent material. It has abrasive resistance 3-5 times of traditional rubber; we can process TPU in almost every method that used in treating plastics; The energy consumption of the processing process is only one-fifth to one-third of that of the traditional rubber. It has top weather fastness, and that’s why all the most demanding environmental aircraft paint is polyurethane. Its low-temperature resistance is particularly excellent. And the adhesion is outstanding. Such good things deserve to be promoted and applied on a large scale. In the past, the obstacle to its large-scale application was its high cost, because it is the traditional rubber that competes with it.

The crazy price hikes of natural rubber and synthetic rubber last year speed up the development of the TPU market. TPU has extensive usages including shoe sole, pipes, cables, films, etc. We can process TPU into the famous spandex when we pulled TPU into silk. Logically speaking, TPU business should be extraordinarily profitable. However, nowadays when you ask those TPU manufacturers, you will astonishingly find out that they are all having a terrible time. Or even worse, only a few TPU manufacturers are making money this year. Some, even worse, are having huge losses. Where is the primary cause? It was the rising price of raw material of TPU! The market is an ecological chain. The TPU raw material manufacturers are changing their prices on daily basis while TPU manufacturers can only change prices once in half a month. The reason is that the companies buying their TPU are selling on monthly basis or even half a year. It is because the price change of the primary raw materials cannot proportionally convey to downstream firms, resulting in the TPU manufacturers and their clients unprofitable or even losing money.

The principal raw materials of TPU include MDI, pure MDI, and adipic acid. Companies producing these raw materials are monopolies. There are seven MDI manufacturers in the world. China so far only has one. The primary manufacturer, Covestro, recently reported that its hardener business this year has twice revenue as last year. I admire the Wanhua Chemical before September 2016. It is its existence that forced the sales price of foreign companies in the Chinese market continuously lowering their price actively. You can't expect tycoons like Covestro, BASF to voluntarily reduce their product’s price in China. Though, the manufacturing costs have not changed much. The market price of MDI, TDI has been rising tremendously. And that’s why this year foreign companies are extraordinarily profitable.

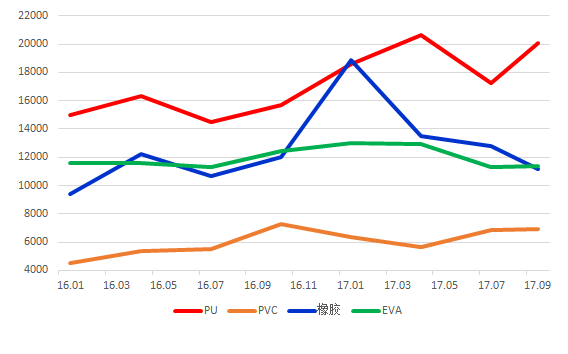

I recently visited some TPU clients, such as shoe factories, cable factories, or other downstream enterprises. And I was surprised to find that their customers have begun to abandon TPU and use different raw materials extensively. As an elastomer with excellent comprehensive properties, I think that more than 70% of the shoe sole need to use TPU, but at present, the figure is even less than 10%. You will know why if you take a look at this chart below- the price is too high!

Currently, the price of TPU is indeed too high. And many TPU granulated material production enterprise can only earn profit less than 10%! The high costs are mostly resulting from rising prices of raw materials, which are already too expensive to be afforded by downstream firms. That’s why they start looking for alternatives to replace TPUs.

The fourth quarter of this year should be TPU's traditional peak season, but when you go to a lot of shoe factories and dealerships, you will find that there is a lot of TPU remained unused. The reason is that the downstream demand is deficient (firms have switched to substitute products!). The downstream downturn is forcing the primary raw material producers to lower the price tremendously. The rules of the market are not that simple. The sharply price-rising of raw material will need at least half a year or even longer time to recover.

The price-rising in primary raw materials will also have two negative consequences:

1, It will prompt other companies to invest in this field on a large scale. The reason is that this area is indeed too profitable! The MDI and TDI manufacturing devices under construction will probably increase global capacity by 20% or more within the next two years. As for TDI, the coatings industry, which accounts for 20% of the market demand, is vigorously developing water and powder systems that do not use TDI. The growth of production capacity and the shrinking demand is happening at the same time. The market will tell you what the answer will be after two years.

2, the competitiveness of the products produced by these materials is weakening sharply, not only in the domestic market but also in the export market.

We expect that the primary raw material manufacturers will pay more attention to the foster their downstream market, or even the downstream of downstream, instead of squeezing out their only profit. Since if no one survives in the competition, who will buy your products?