Although the finished-shoe products are not included in the list of 10% increase of import tax rate for Chinese commodities, international buyers have already started to place part of their finished-shoe orders to the manufacturers in South-East Asia, under the uncertain possibilities of escalating of the trade friction in the near future. Meanwhile, as those shoe-making materials including rubber have been listed for a tax increase, a rise in production cost would surely be seen.

The shoe industry in Dongguan has taken positive actions to diminish the impacts brought by the China-US trade friction.

1、Find more substitutes for raw materials from other markets in the world, to offset the possible increase of cost due to the trade friction, and at the same time, maintaining the quality of the finished products.

2、Expand the domestic market, and ensure a reasonable profit (some enterprises are exploiting the market using their own brands).

3、Implement the automatization of production lines, optimize the production efficiency, reduce unnecessary manpower waste, cut down the production cost, and offset the loss brought by the tax arising.

Some large-scale shoe producers are using their manufacturing facilities abroad to avoid the influence of tax arising. Since the 2008 financial crises, several shoe-making magnates including Yuyuan group, Huajian group and Dalipu group have accelerated transferring the production to South-East Asia. Huajian group, one of the largest women-shoe manufacturers in China, has set up a new production site in Ethiopia in the year 2011.

Moreover, the governmental departments have been putting their efforts into optimizing the market for the export-oriented companies. Since November 1st this year, the current tax-refund rates have been raised, 16% substitutes for those of 15% and part of the 13%, 10% and some 13% substitutes for 9%, and 6% and some 10% substitutes for 5%. Meanwhile, the average processing time for tax-refund has been required to adjust into 10 days by the local government.

For those finished-shoes with brands, the costs of developing new supply chains must be considered, as well as production cost, tax levels and quality control. For example in South-East Asia, the only advantage among those facts relating to production cost is the lower salaries paid to the workers, while the situations in transportation of raw materials, working efficiency, and stable working-hours are still much worse than those in China. Besides, the development of shoe industry in South-East Asia is actually the expansion of production capacity for Chinese shoes manufacturers. Most of the shoe factories here are Chinese owned.

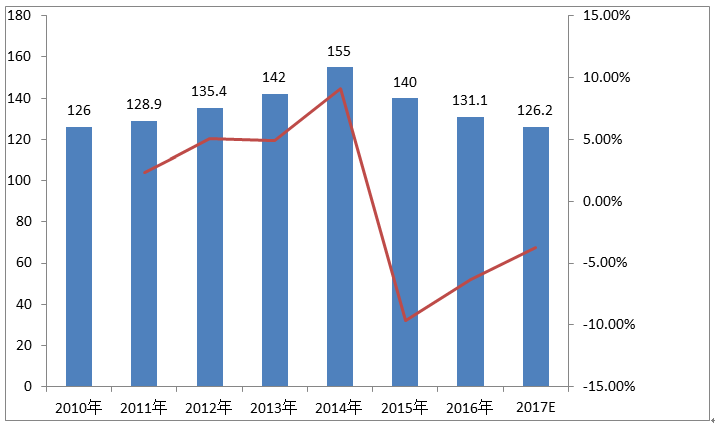

After decades of development, shoe industry in Dongguan city has established a perfectly formed supply system, and become the center place for professionals in this field, playing a decisive role in global shoes market. Although the exporting capacity has a minor decrease in recent years, there is an obvious increase in unit prices, having an average price of over 20 US dollars. An appropriate time for industrial upgrading and survival of the fittest has come alongside the trade friction.